Which Best Explains Why Banks Consider Interest on Loans

Read the graph that displays interest and total payments on a loan. Banks set interest rates correspondingly to the rates set by the Federal Reserve.

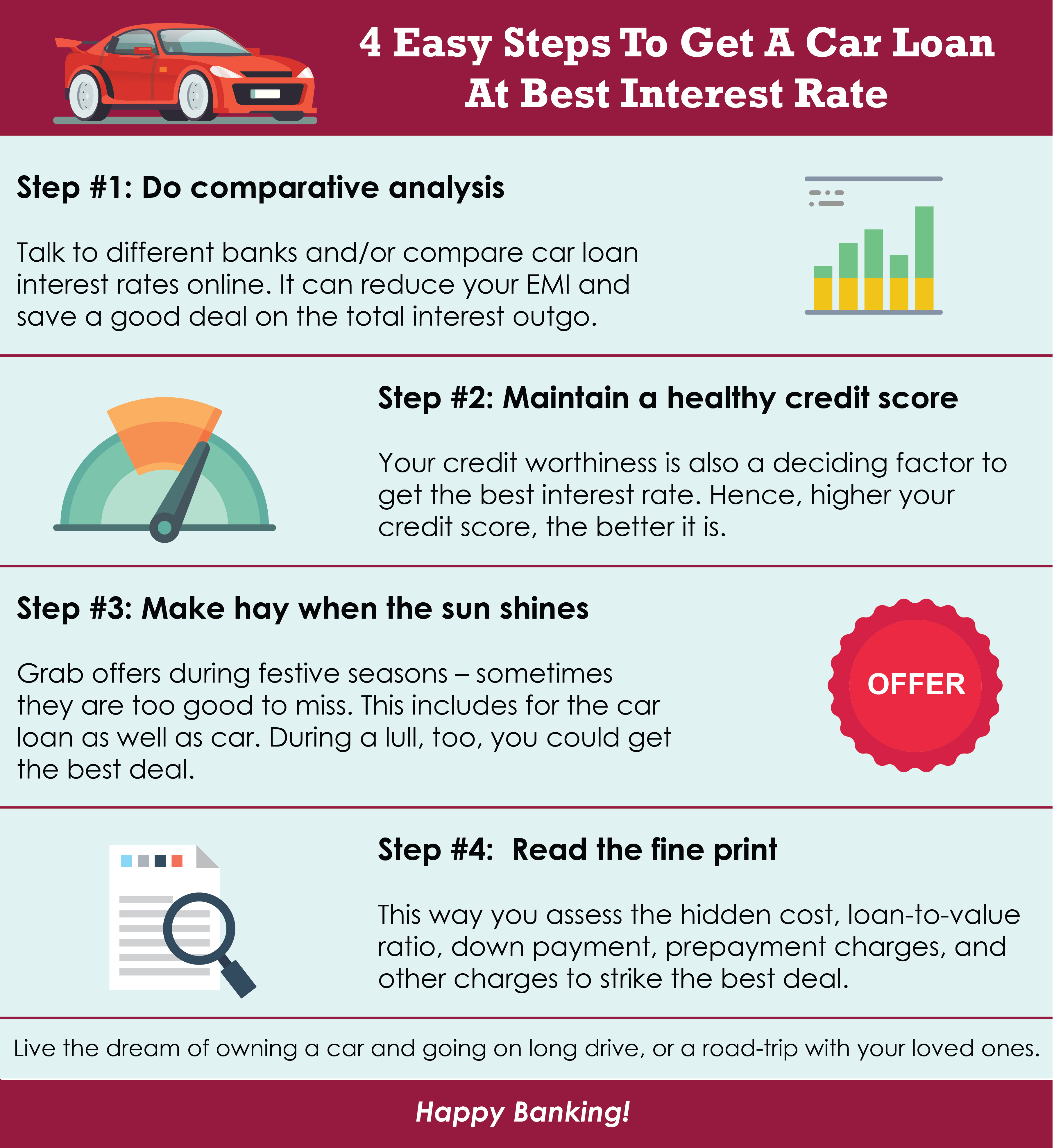

4 Easy Steps To Get A Car Loan At Best Interest Rates Read This Infographic To Know The 4 Easy Steps To Get Aca Car Loan Calculator Car Loans Loan Calculator

Interest allows banks to cover business costs.

. Which best explains why banks consider interest on loans to be important. See full answer below. They also consider the interest rates charged by competitors.

Interest help them cover businesses costs. Answer Which best explains why banks consider interest on loans to be important. Which best explains why banks consider interest on loans to be important.

The correct answer is A. Which best explains why banks consider interest on loans to be important. Which best explains why banks consider interest on loans to be important.

It is there greatest source of income. In US businesses cant discriminate on the basis of race or gender or any other of the Protected Class Status residents so the only way to estimate someones likelihood of. As very few of us are able to make large.

Interest enables them to stockpile money. Which best explains why banks consider interest on loans to be important. Which best explains why banks consider interest on loans to be important.

Interest rate plays a role in your decision to borrow money. Interest helps them cover business costs. Which best explains why banks consider interest on loans to be important.

I Interest helps them cover business costs. Although this may. When a bank lends you money they charge you a percentage of that loan which is payable monthly.

Interest enables them to control the economy Interest helps them to satisfy customers Interest enables them to stockpile money Interest helps them cover business cost. Interest helps them cover business costs. Which statement best describes the effects of low and high interest rates on the economy.

Banks make the most money and take the most risk with an interest rate of. In modern times lenders are usually banks although other institutions and companies can also be money lenders. Which best explains why banks consider interest on loans to be important.

Banks are businesses and businesses are designed to make money. In simple terms interest rates refer to the cost of borrowing money. Interest helps them to satisfy customers.

Interest helps them cover business costs. Therefore when a person borrows money he pays interest. Interest helps them cover business costs.

Interest enables them to control the economy. Interest enables them to stockpile money. Interest enables them to control the economy.

Correct answer to the question Which best explains why banks consider interest on loans to be important. Retail banks loan money to small businesses while commercial banks loan money to large corporations. Banks consider interest on loans quite significant because interest helps them cover business costs.

The balance in the account represents a 10 compensating balance for a. Interest helps them to satisfy customers. Ii Interest enables them to control the economy.

Which best explains why banks consider interest on loans to be important. Which best explains why banks consider interest on loans to be important. Interest helps them cover business costs is the correct answer.

Collectivist societies are those in which the benefits of the majority are considered over the benefits of the individual and the value of the individual is considered according to their capacity to contribute. PolarNik 594 1 year ago. Interest rates affect most people and the financial decisions they make.

When a bank loans money it earns interest. Interest is the cost. Answer 1 of 12.

It is quite common for banks to increase interest rates payable on loans but they hardly reduce the rates after giving out the loans. Questions in other subjects. Interest enables them to control the economy.

Up to 256 cash back Which best explains why banks consider interest on loans to be important. Densk 106 1 year ago. It is also considered a compensation to the lender for taking the risk of lending money.

But if a question were asked to fill in the word that best.

How Do You Ensure Low Intrest Rates For A Personal Loan Personal Loans Personal Loans Online Interest Rates

Lowest Home Loan Interest Rates Top 4 Banks In 2022 Loan Interest Rates Home Loans Interest Rates

Advantages Of Gold Loan Types Of Loans Finance Loans Loan Company

Business2success Entrepreneur Life Citations Motivantes Citation Inspirante Motivation Web Entrepreneu Business Money Money Management Advice Money Skills

Comments

Post a Comment